A Promising Start to 2024 for Buyers and Sellers

carolinastory

on

January 2, 2024

Charting New Horizons: A promising start to 2024 for buyers and sellers.

As we bid farewell to 2023, a challenging year for many, the real estate market is already showing a promising start in 2024 for buyers and sellers. With mortgage rates dropping by 150 basis points, and the possibility of the Federal Reserve cutting short-term interest rates in the coming months, the real estate landscape is evolving. Let’s delve into the key highlights from recent reports and analyses.

Labor Market Insights

The Job Openings and Labor Turnover Survey (JOLTS) report for November 2023 indicates a gradual ‘loosening up’ of the labor market. While total job openings slightly decreased to 8.8 million, it remains a substantial figure, marking the lowest JOLTS figure since March 2021. The ADP private employment report for December 2023 brought mixed messages, revealing a larger-than-expected job growth of 164,000, primarily in the services sector. However, the manufacturing sector experienced minimal job growth. Wage growth also slowed down, showing +5.4% YoY for job stayers and +8.0% YoY for job leavers.

Real Estate Market Trends

Home Prices

According to the Case-Shiller home price indexes for October 2023, national home prices continued to rise, recording a 0.6% MoM increase. This marked the 9th consecutive monthly increase, with 13 cities setting new all-time highs. The national price index has risen by 5.4% over the course of 2023.

rental rates

While home prices soared, rental rates experienced a decline. In December 2023, rents were down 1% YoY, marking seven consecutive months in negative YoY territory. The vacancy rate of 6.5% has returned to pre-pandemic levels, and with a record number of units under construction, it is expected to rise further.

city wise analysis

Looking at the 20 major city indexes, only 7 cities remain below their mid-2022 peaks. San Diego, Detroit, New York, Los Angeles, Boston, and Chicago exhibited the strongest performance in 2023, while Portland saw a slight decrease, indicating the first ‘double dip’ in prices.

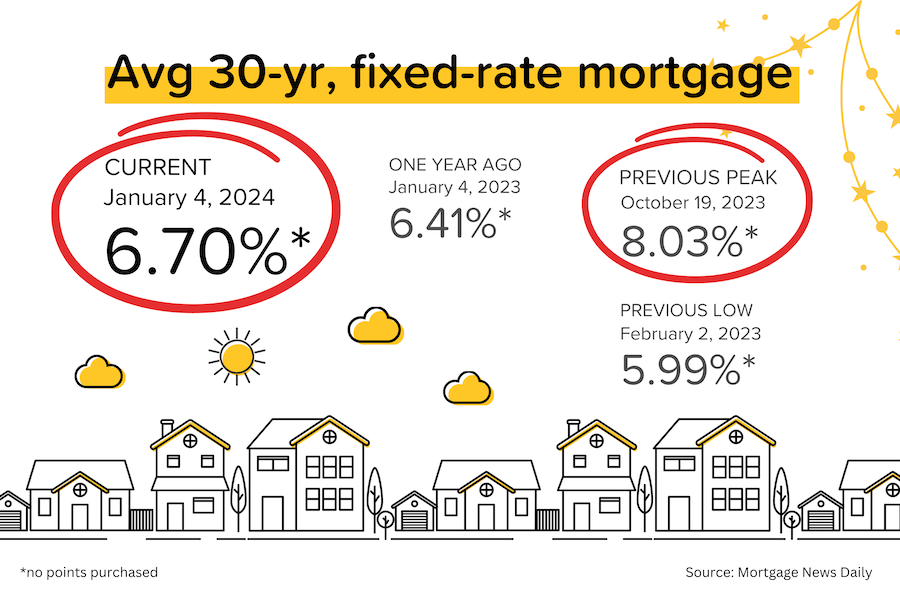

Mortgage Market

The average 30-year mortgage rates, though showing a slight increase in the last weeks of 2023, remained below 7%. The upcoming Fed rate decision on January 31 is currently expected to result in no change, but the subsequent meeting on March 20 has a 60% probability of a 25 bps cut.

The Charlotte Region

The softening trend observed in 2023 is expected to persist in 2024, as evidenced by November’s median sales price for homes in the Charlotte region, which experienced a marginal decline of 0.8% year-over-year, settling at $379,000.

Realtor.com economists attribute this correction to the previous surge in buyer demand during the pandemic, leading to a sharp increase in home prices and subsequent inventory challenges. The tight inventory situation in 2022 and 2023 contributed to a moderation in price growth, aligning with the decrease in buyer affordability. This correction is anticipated to continue in 2024, although buyers should not anticipate drastic price falls, given the historically robust demand in our market.

Sellers, who have seen record home equity in recent years, need not fret about declining home values. However, collaboration with listing agents to ensure well-priced homes at the neighborhood level is crucial. In November, the median home price in Mecklenburg County was $421,000, while in the city of Charlotte, it was $401,000, both showing a slight increase over the previous year due to limited inventory.

List Price-to-Sales Price ratios, a key metric, have remained high in recent years, with November registering at 96.9 percent. This indicates that sellers are receiving nearly all of their asking prices for homes. While this metric may experience marginal fluctuations, it is anticipated that sellers will continue to secure most of their asking prices.

Inventory and supply are expected to grow gradually, but challenges will persist. In November, the 16-county region had approximately 6,500 homes for sale, representing 1.9 months of supply. Mecklenburg County, with around 2,100 homes for sale, had 1.4 months of supply in November. Consistent new listing activity is crucial to overcoming supply challenges and achieving a more balanced market.

The delicate balance between demand, low inventory, and rising prices is evident. As demand rises and inventory remains low, prices are likely to increase. Conversely, when demand stabilizes, and sellers contribute to the inventory, prices tend to soften. While the ideal scenario involves an increase in inventory and supply, moving closer to a “balanced market” with around 6 months of supply, the current conditions indicate a continued seller’s market in the upcoming year

U.S. existing-home sales experienced a rebound, rising 0.8% from the previous month and breaking a five-month declining trend, as reported by the National Association of REALTORS® (NAR). However, despite this improvement, sales were still down by 7.3% compared to the same period last year, primarily due to ongoing affordability challenges for potential buyers. The majority of closed sales during this period were initiated in October when mortgage rates reached a two-decade high. Since then, with rates dropping by over a full percentage point, there is a possibility of continued growth in existing-home sales in the upcoming months.

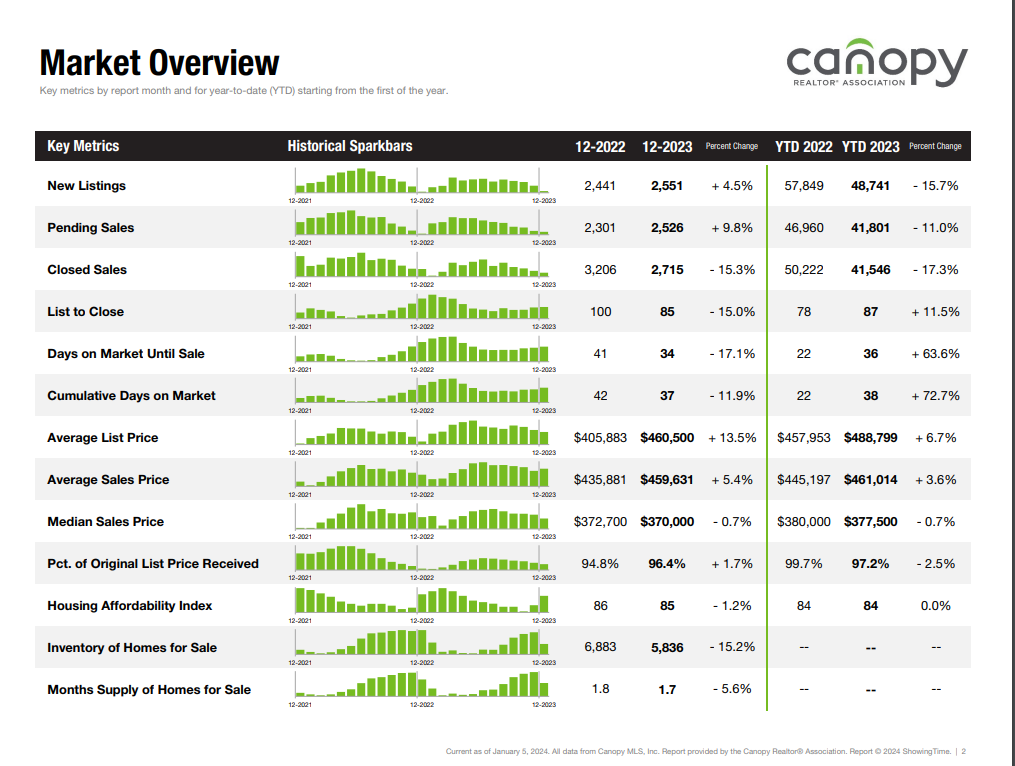

In the Charlotte region, new listings increased by 4.5% to reach 2,551, while pending sales saw a notable rise of 9.8% to reach 2,526. Concurrently, inventory decreased by 15.2%, reaching 5,836. Median sales prices experienced a slight decrease of 0.7%, settling at $370,000. The Months Supply of Homes for Sale also decreased by 5.6%, reaching 1.7 months, indicating an increase in demand relative to supply.

The persistently low levels of inventory across the U.S. housing market are impacting home sales, limiting options for potential buyers. As of December, there were 1.13 million units for sale, marking a 1.7% decrease from the previous month but a 0.9% increase from the same period last year. This results in a 3.5 months’ supply at the current sales pace. Consequently, home prices remain high nationwide, with NAR reporting a 4% annual increase in the median existing-home price to $387,600, reflecting the fifth consecutive month of year-over-year price gains.

While there is an uptick in homebuyer demand, the limited increase in supply suggests that home prices are likely to remain elevated for an extended period, according to experts.

Empower Your Real Estate Journey: Take Action in 2024!

Ready to navigate the evolving real estate landscape and make informed decisions in 2024? Stay ahead of the curve by staying informed. Explore the latest trends, market insights, and expert opinions. Whether you’re a buyer, seller, or simply curious about the real estate market, empower yourself with knowledge. Dive into the details and seize the opportunities that lie ahead. Your journey begins here – click, explore, and embrace the future of real estate! Connect with me as your guide in all things real estate!

- Category: Real Estate, Home Buyers, Home Sellers

- Tag: home buyers, Home Seller, Real Estate, real estate market

Posted by carolinastory

Hey y'all! I'm Angelle', the founder of Your Carolina Story - A strong tribe of Charlotte (and surrounding area) residents who get weekly information about the best events, restaurants, shopping, activities, and real estate in and around the Charlotte area. Plus, the best hiking, biking, health and wellness options, new hot spots, and more! Click below to follow us.