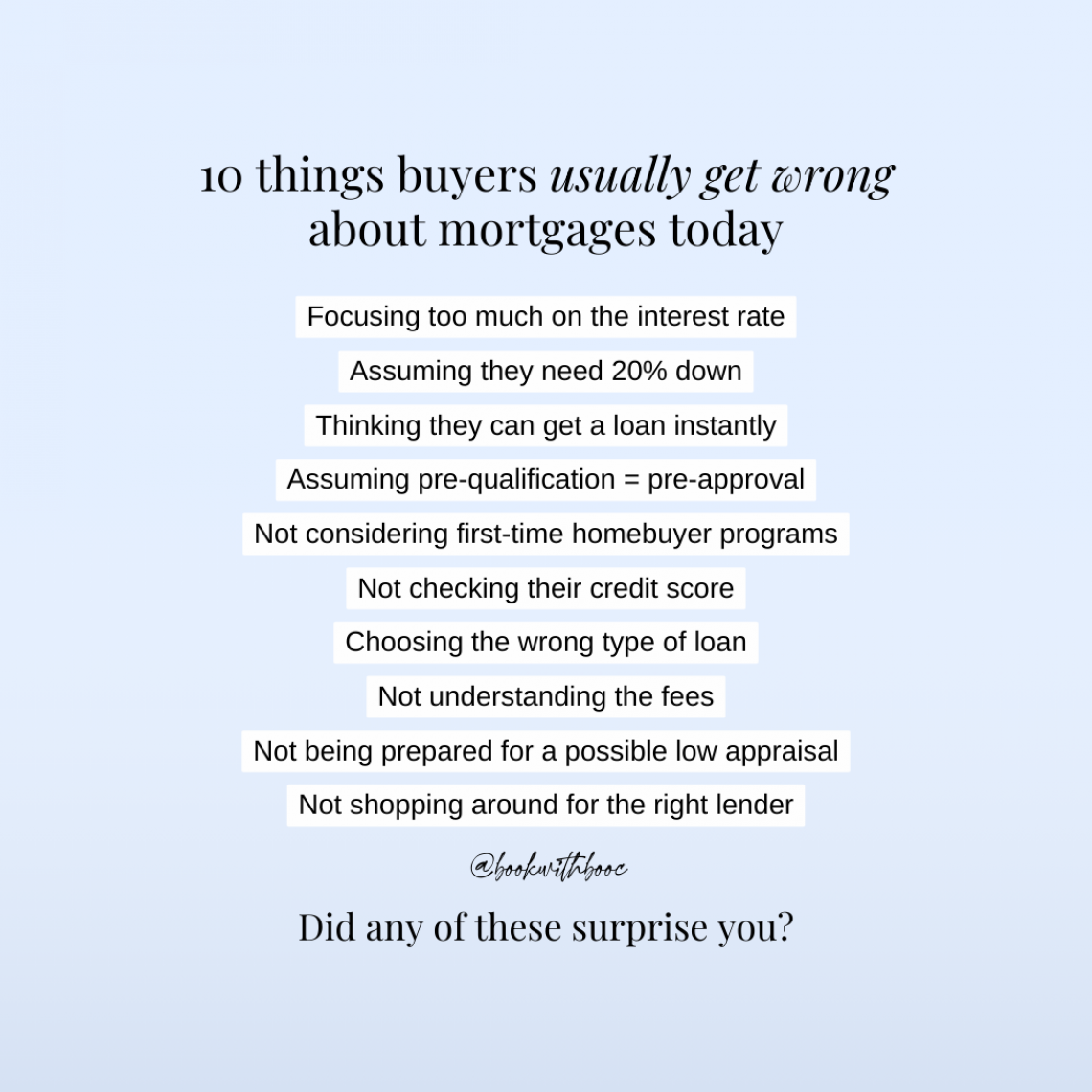

Mortgages today: Debunking the Top 10 Mortgage Myths for Homebuyers

Purchasing a home is one of the most significant investments you’ll ever make. It’s an exciting journey, but it can also be fraught with misconceptions, especially when it comes to securing a mortgage. To help you navigate this process, we’ve debunked the top 10 mortgage myths that buyers often believe. Understanding these myths can make your home-buying experience smoother and more successful.

1. Focusing Too Much on the Interest Rate

While a low interest rate is important, it’s not the only factor to consider when choosing a mortgage. Many buyers become fixated on securing the lowest rate possible and overlook other crucial aspects such as loan fees, terms, and overall costs. For instance, a mortgage with a slightly higher interest rate but lower fees might be more cost-effective in the long run. Always look at the total financial picture, including the Annual Percentage Rate (APR), which reflects both the interest rate and additional costs.

2. Assuming They Need 20% Down

A 20% down payment has long been considered the gold standard, but it’s not a requirement. Various loan programs allow for significantly lower down payments. For example, FHA loans require as little as 3.5% down, while VA loans offer $0 down for eligible veterans. These programs make homeownership more accessible, especially for first-time buyers. It’s essential to explore all your options and find a down payment strategy that works for your financial situation.

3. Thinking They Can Get a Loan Instantly

Securing a mortgage is a detailed and often lengthy process. It involves comprehensive documentation, verification, and review of your financial history. Lenders will need to see your income, employment records, credit history, and more. This process can take several weeks, so it’s crucial to start early and be prepared with all necessary paperwork to avoid delays.

4. Assuming Pre-Qualification Equals Pre-Approval

Pre-qualification and pre-approval are not the same. Pre-qualification is an initial assessment of your financial situation based on the information you provide, giving you an estimate of how much you might be able to borrow. Pre-approval, on the other hand, involves a thorough examination of your finances by the lender, resulting in a more definitive and credible loan amount. Pre-approval carries more weight with sellers and can strengthen your offer.

5. Not Considering First-Time Homebuyer Programs

First-time homebuyer programs can offer significant benefits, including down payment assistance, lower interest rates, and reduced fees. These programs are designed to make homeownership more affordable and accessible. If you qualify, taking advantage of these programs can save you a considerable amount of money and make the buying process less stressful.

6. Not Checking Their Credit Score

Your credit score plays a critical role in determining the terms of your mortgage. A higher credit score can lead to better interest rates and loan terms. Before you start the home-buying process, check your credit score and take steps to improve it if necessary. This might involve paying down debts, correcting any errors on your credit report, and avoiding new credit inquiries.

7. Choosing the Wrong Type of Loan

There are various types of mortgage loans, each with its own terms, requirements, and benefits. Conventional loans, FHA loans, VA loans, and USDA loans are just a few examples. It’s essential to research and understand the different loan options to find the one that best suits your financial situation and homeownership goals. Working with a knowledgeable mortgage advisor can help you navigate these choices.

8. Understanding the Fees

Mortgages come with a variety of fees, including origination fees, appraisal fees, and closing costs. It’s crucial to work with a transparent lender who will explain all associated fees upfront. Understanding these costs can help you avoid surprises at closing and budget accordingly.

9. Not Being Prepared for a Possible Low Appraisal

A low appraisal can be a significant hurdle in the home-buying process. If the appraisal comes in lower than the purchase price, you may need to renegotiate with the seller or come up with the difference in cash. Having a plan in place for this possibility can help you navigate this situation without jeopardizing your purchase.

10. Not Shopping Around for the Right Lender

Every lender offers different terms, rates, and programs. Shopping around and comparing offers from multiple lenders can ensure you get the best mortgage for your needs. Don’t settle for the first offer you receive; take the time to explore your options and negotiate terms that work in your favor.

In Conclusion

Understanding these common mortgage myths can save you time, money, and stress as you embark on your home-buying journey. If you have more questions or want personalized advice, don’t hesitate to reach out. We’re here to help you find the perfect home and mortgage that fits your needs.

Ready to take the next step? Contact us today to discuss your mortgage options and start your journey to homeownership!

Your home search journey starts here: angellebooc.kw.com